The Quest For Unicorns

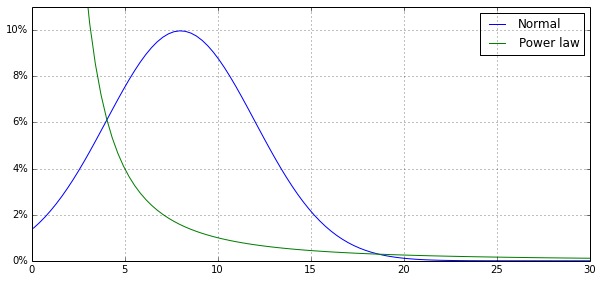

The power law distribution of returns in angel and venture capital investing has three important implications for investors: Make sure to diversify, pay attention to deal flow quality, and treat investments as real options. Investors often write off as many as half of their investments. Historical data confirm that most investments will return very little or even lose money, many still return some multiple on initial investment, but it is the very small handful of “hyper performers” that return an outcome well outside what could be expected in a normal distribution which not only more than compensate for losses but also generate most of a portfolio’s returns.

Most angel investors and VC's, due to size constraints and time limitations, focus their attention on their "hyper performers". Our team works with these investors to provide strategy, financial modelling, networking, board reporting framework and due-dilligence to those portfolio companies in the "tail".

Power laws have a property that normal distributions do not: fat tails. The fatter the tail, the higher the probability of outsize events.